How many of us understand our electricity bills? Why is electricity more expensive than gas? How can we reform our bills? My latest blog reveals all.

UK Domestic Electricity Costs (2025)

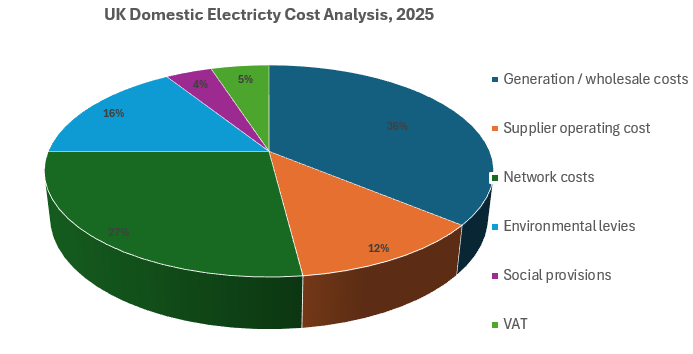

The surprising thing is that the wholesale cost of generating electricity is only 36% of the total cost. There are huge variations within this ‘average’ generation cost. Recent onshore wind and solar assets are cheap to operate but the UK grid relies on natural gas power stations to provide peak demand (see Cost of Energy blog).

Network Costs (27%)

Maintaining and operating the transmission and local distribution network is 6 and 12% of the total cost respectively. This has been increasing, and will increase further, to pay for new power lines to connect renewables to areas of demand and to upgrade the grid to provide sufficient power for electric vehicles and heat pumps.

Balancing costs (4%) cover expenses incurred by the National Energy System Operator (previously the National Grid) to maintain electricity supply in line with demand 24 hours a day. This includes constraint payments (where generators are paid to switch surplus generation off) and auxiliary services for detailed frequency response and to maintain a steady voltage across the network.

Generators can place bids into the Capacity Market (3%) auction to supply electricity for peak periods, such as 4-7pm in winter. Gas generators are the largest recipient of these payments, followed by battery storage projects and demand reduction aggregator services.

The UK has a programme to install a smart meter (2%) in every household by 2030. Smart meters are fitted for ‘free’ although this is paid for by a levy on all our bills. Smart meters provide real time information, avoid the need for physical meter readings and enable new time-of-use tariffs that are essential to efficiently operate electric cars and heat pumps.

Environmental and Social Costs (20%)

The Renewables Obligation (RO) was a scheme to encourage generators to build and supply more renewable electricity. The scheme ended in 2017, and these legacy payments (11%) will gradually wind down to 2037 (maximum 20-year contracts).

The RO was replaced by contracts for difference (3%) which are a more cost-effective way to encourage the construction of new renewable energy. Developers agree a ‘strike-price’. If the market price for electricity is below the strike price the generator is paid the difference, but if the market price is above then the generator pays back the difference. So, there is a guaranteed income stream for the generator (and investors) and better sharing of risks and rewards.

Feed-in-tariffs (2%) were a government initiative to pay consumers to install small-scale domestic renewable energy. They were introduced to kick-start a new industry with tariff rates reduced over time as the market adapted. The last scheme was closed in 2019, and like the RO payments will gradually decline over 25 years. I installed solar panels at home in 2010 and will continue to receive a feed-in-tariff until 2035. My gain is paid for by every electricity bill payer.

‘Social provisions’ (4%) comprise the Energy Company Obligation (ECO) and the Warm Homes Discount. ECO is an obligation on energy suppliers to invest in energy efficiency measures for vulnerable and low-income households. It has operated since 2013 and has had some success, but also critics who argue that energy suppliers are conflicted as they have little incentive to reduce their customers’ energy consumption. The Warm Homes Discount is an annual £150 discount off electricity bills for around six million vulnerable and low-income customers. This is funded by a levy within everybody’s standing charges (including those who receive the £150 discount).

The UK Government has announced changes from April 2026. The ECO scheme for gas and electricity will be abolished and replaced by the Warm Homes Plan. In addition, 75% of the remaining RO costs will be met by the Exchequer (taxpayer).

This will reduce the average household energy bill by around £150 - a 13% reduction in electricity bills and 6% for gas.

The Price Cap

Following the Russian invasion of Ukraine there were huge spikes in the wholesale price. The price rose from under £50 MWh to a peak of over £350.

The UK Government introduced measures to cushion domestic consumers from these steep price rises and ever since has maintained a ‘price cap’ – the maximum amount suppliers can charge consumers per unit of electricity. The price cap is currently set at £270 MWh, equivalent to 27p per unit of electricity. The difference between actual costs and the price cap is paid for by the Government (taxpayers).

The price cap is currently £1,758 which is the estimated energy bill for an average household. You will pay more if you use above average energy and vice versa. The price cap is split between electricity (2,900kwh, £950) and gas (12,000kwh, £800).

Under the January 2026 price cap, a unit of electricity (27.7p) costs 4.7 times more than a unit of gas (5.9p). This is a problem as it is expensive to electrify your heating. The Government’s proposed changes from April may reduce this a little to around 4.3 times.

Standing v Variable Charges

Total costs are allocated between standing and variable charges. Your standing charge is calculated to cover the fixed costs of operating the network, metering costs and supplier overheads. It also includes the costs necessary to pay the Warm Homes Discount.

Standing charges are around £200, 21% of an average £950 electricity bill. This is a high proportion and disproportionately affects low electricity users who must pay the same standing charge as everyone else.

What about Gas Bills?

There is a huge discrepancy between electricity and gas bills. Most of the environmental and social levies on electricity bills do not apply to gas. Gas bills include a share of ECO (to be abolished in April 2026), a share of the Warm Home Discount and a small Green Gas Levy to support biomethane. Overall, such levies add around 5% to a gas bill, but 17% to an electricity bill.

Discussion

There is upward pressure on electricity bills to pay for the expanded transmission and distribution networks required for renewable energy, and to cope with the expected increase in our demand for electricity. Fortunately, new renewable generation can be cheaper than natural gas, so the long-term outlook is favourable.

To encourage consumers to move to electric low carbon heating we must reduce the large gap between the unit price of electricity and gas.

There are environmental levies on electricity which do not apply to gas. As a result, electricity is now far greener than burning gas, but these levies have placed an unfair burden on electricity costs relative to gas. Therefore gas should have a carbon tax applied to it or a higher Green Gas Levy. After all we have a plan to get to a 100% low carbon electricity supply by 2030 but why is there no plan for gas?

The Government is planning to abolish the ECO scheme and shift the burden of the RO scheme from April 2026. This will reduce electricity and gas prices but has a bigger effect on electricity. There is a logic to shift electricity levies to general taxation as this will help to support low carbon heating. General taxation is also more progressive (bigger impact on wealthier families) than electricity bills. However, this planned shift is not sufficient.

The legacy feed-in-tariff payments and the levy for the Warm Homes Discount should also be shifted to general taxation. Do consumers understand that they pay higher standing charges to reduce bills for those on low incomes?

But there is no such thing as a free lunch and there is the principle that all subsidies for fossil fuels should be abolished. So we should charge the full 20% VAT on gas and electricity bills.

A lower electricity standing charge and higher variable rate would assist those who live in smaller low-usage homes and would encourage those in larger homes to invest in energy efficiency. The levy for the Warm Homes Discount should be removed from standing charges. A more radical idea would be to charge the variable rate in price bands dependent on usage. Charge the first 1,000 or so units at a cheaper rate with ‘excessive use’ charged at a higher rate.

Of course, any changes will have winners and losers.

If you like this blog, please share it with your friends and on social media.

Stay Connected and Discover More

Join my mailing list to get first sight of all my new blogs. Email This email address is being protected from spambots. You need JavaScript enabled to view it. with the header “please subscribe”.

Connect on social media: LinkedIn, X, Facebook, Instagram, Bluesky

You might also enjoy my book Carbon Choices, on the common-sense solutions to our climate and nature crises. Available from Amazon or order a signed copy. I am donating one third of profits to rewilding projects.