What is an energy subsidy? Why can’t we simply abolish them? What effect do they have?

But, firstly I’d like to let you know that I have upgraded my website. It is now a secure site, and you can see all my blogs by date published, or search by keyword or by blog categories. Carbon Choices also features at number 10 on FeedSpot’s list of the 40 best Carbon Blogs and websites in 2025. Please let your friends and colleagues know!

You will often hear politicians say that they will end subsidies for fossil fuels. The chances are that they don’t mean what they say! Ending all fossil fuel subsidies, however desirable, is often political suicide.

An energy subsidy is any government action that lowers the cost of energy production, raises the price received by an energy producer or lowers the price paid by energy consumers. It could be aimed at lowering energy costs for consumers or designed to increase production. Its stated purpose could be to support economic growth, provide energy security, protect consumers or to cut pollution or carbon emissions. Subsidies are offered by all governments for most if not all energy sources, including fossil fuels and renewable energy.

It is difficult to change or abolish subsidies as the ‘losers’ from any change will be more unhappy than the ‘winners’ are made happy.

Global Promises

Climate economists are clear that one of the most efficient ways to tackle climate change is to get energy prices right. In broad terms this means taxing carbon emissions to account for the damage that they cause. Fossil fuel subsidies are the antithesis of this. Even if you don’t tax carbon emissions, the International Energy Agency (IEA) argues that the one of the most cost-effective actions to tackle climate change is to scrap all fossil fuel subsidies.

In 2009 the G20 promised to phase out “inefficient” fossil fuel subsidies. This pledge was repeated by all governments at COP26 in 2021 but with no end date specified. Progress has been hampered by disagreement over definitions, lack of detail in the pledges, and lack of an action plan. Even worse, fossil fuel subsidies increased following the Russian invasion of Ukraine as a temporary measure to protect consumers from rising energy prices.

Definition of a Subsidy

The World Trade Organisation’s technical definition can be read here. In my words, an energy subsidy is any government action to lower the cost of energy production or lower the price paid by consumers. An "inefficient" subsidy is something that encourages wasteful consumption.

Money can be paid by a government to reduce the cost of producing or consuming fossil fuels, for example grants and loans, or it can be revenue foregone, for example tax credits or tax exemptions.

In one report the International Monetary Fund extended this definition to include ‘implicit’ subsidies. These are the social costs associated with the consumption of fossil fuels. Economists call these ‘externalities’. This includes the health impacts of air pollutants, the environmental and social damage of climate change from the CO2 released, and e

ven includes the social cost of road accidents and congestion.

Global Subsidies

Fossil fuel subsidies soared after the Russian invasion of Ukraine, from $500bn to over a $1 trillion per year. In 2020, Iran topped the list for consumption subsidies (e.g. cheap petrol prices) followed by China and India. Those subsidies, dominated by price subsidies for consumers, reached almost $1.7 trillion in 2022. In aggregate, most countries provide a higher level of subsidies for fossil fuels than for renewable energy. This particularly applies to petroleum-producing countries like the USA, Saudi Arabia and Russia.

However, using the wider definition used by the International Monetary Fund, global fossil fuel subsidies were around $7 trillion in 2022, apportioned as follows:

- Explicit subsidies, 18%

- Foregone VAT on social costs, 5%

- Social costs of air pollution, 30%

- Social costs of climate change from burning fossil fuels, 30%

- Vehicle externalities (road accidents, traffic congestion, and road wear and tear), 17%

These wider costs are an important consideration, but are not ‘subsidies’ in my view. They are estimated costs arising over many years and importantly they are not real expenditure or a source of new revenue that can be repurposed by governments to a better use. Including vehicle externalities is also odd, as these would be equally as large if every vehicle was powered by electric batteries.

UK Energy Subsidies

The UK has many energy subsidies, often implemented to reduce fuel poverty or to tackle the ‘cost-of-living’ crisis.

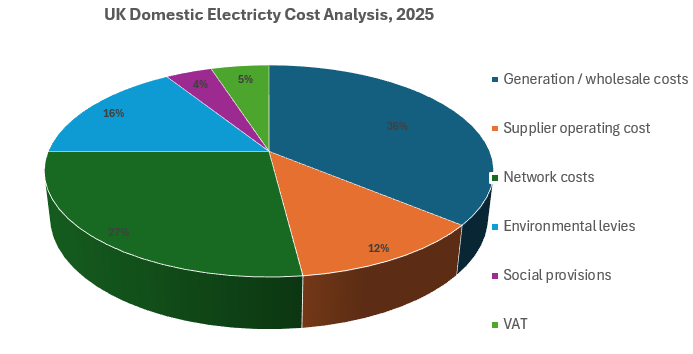

VAT is levied at a reduced rate of 5% on household natural gas and electricity bills, compared with the standard rate of 20%. This is a subsidy for household energy, a significant proportion of which is still supplied by fossil fuels.

There are other consumer subsidies including the Winter Fuel Allowance and a discounted price for heating oil. Meanwhile, oil and gas drilling benefits from tax breaks and allowances for exploration and investment in new fields. Some also argue, with reason, that grants to promote carbon capture and storage are really a subsidy to prolong the use of fossil fuels. Global Justice Now estimates that the UK Government provides £17 billion per year in fossil fuel subsidies.

One minor subsidy is the Cold Weather Payments system in England. If the average temperature in your area falls below 0oC for a week then most people on benefits will be paid £25. This is a sensible and targeted subsidy – paid only during unusually cold weather and benefitting only those on lower incomes.

Following the Russian invasion of Ukraine the UK Government introduced the Energy Price Guarantee and Energy Bill Support Scheme for households, and the Energy Bills Relief Scheme for businesses. Some £39bn was provided under this scheme.

Implications of Fossil Fuel Subsidies

Generally they reduce the price of energy supplied from fossil fuels.

This tends to increase demand and reduces the benefits (payback period) of investing in energy efficiency measures therefore increasing air pollution and CO2 emissions. Even worse it hinders the cost effectiveness of innovation and investment into cleaner forms of energy and therefore acts against the growth of renewable energy.

Consumption subsidies are often introduced to reduce fuel poverty and to help lower income households. However, many subsidies are not that well targeted. Richer people have larger houses and travel more, so they benefit more from fossil fuel subsidies. This particularly applies to aviation subsidies (most jet kerosene is not subject to the same excise taxes as are applied to similar transport fuels) which discriminates against ‘greener’ train travel, and disproportionately benefits richer households who tend to fly more.

Subsidies, like lower rates of VAT levied on energy, reduce a government’s tax income which must be made up from higher taxes elsewhere.

Political Astuteness, or Cowardice?

To be fair on our politicians, the public do not like governments abolishing subsidies that they have got used to. There are examples from across the world, including the ‘gilets jaunes’ protests against increases in fuel taxes in France, riots in Iran, and the recent political storm in the UK over the Government’s attempt to restrict the winter fuel allowance for pensioners.

Strong political direction is required with a clear communication strategy to explain the benefits for society and for the climate of the proposed changes. Subsidies can be phased out, the money saved can be redirected to energy and social programmes (investment in home energy efficiency) or governments can offer targeted support to vulnerable households.

What about Renewable Energy Subsidies?

Of course, there are numerous subsidies designed to encourage the production and consumption of renewable energy. I have taken advantage of these, for example, claiming feed-in-tariffs for solar photovoltaic panels and a grant for my electric heat pump. And companies that supply electricity to the grid generated by wind turbines or solar generators can claim contracts for difference - government guarantees to help de-risk the development of new, cleaner sources of electricity.

In my view these subsidies can be justified to encourage investment and to ‘kick start’ new technology with environmental and economic benefits. For example, solar feed-in-tariffs were gradually phased out as the cost of solar panels continued to fall. Now the solar industry can compete without subsidies. Similarly, the contracts for difference awarded to new wind and solar generators have been falling which will lead to downward pressure on electricity prices.

Conclusions

Yes, we should phase out fossil fuel subsidies. It is scandalous that governments provide extra support to the fossil fuel industry. We should go further, and tax the use of energy (as we do already with road fuel tax). These actions will encourage investments in energy efficiency and accelerate the shift to renewable energy.

If any change will specifically adversely affect lower income households, then we can ameliorate this through other means, such as raising specific benefits.

For further information on fossil fuel subsidies, I recommend the Fossil Fuel Subsidy Tracker.

[Blog updated following helpful feedback from Ronald Steenblik, former (retired) OECD Special Counsellor for Fossil Fuel Subsidy Reform].

--------------------------------------------------------------------------------------------------------------------------

Carbon Choices

To join my mailing list, email me at This email address is being protected from spambots. You need JavaScript enabled to view it. with the header “please subscribe”.

You might also enjoy my book, Carbon Choices, on the common-sense solutions to our climate and nature crises. Available from Amazon or a signed copy direct from me. I am donating one third of profits to rewilding projects.

Please follow me on social media:

LinkedIn, X, Facebook, Instagram and now on Bluesky