From April 2025 there were big changes to UK car tax. Will this help to promote electric cars? Are they fair?

Introduction

Car taxes are a substantial source of revenue for any government. This blog covers car tax, fuel duty, VAT, company cars and salary sacrifice schemes in the UK.

From 1 April 2025, there were significant changes to car tax, officially called Vehicle Excise Duty (VED). For the first time all electric vehicles (EVs) have to pay VED and there are large increases in the ‘showroom’ tax payable when you buy a new car. Petrol and diesel cars are being priced out of the market.

In the medium-term further structural changes in fuel duty will be necessary because revenue from the sale of petrol and diesel will fall as more and more of our fleet switches to electric.

What are Taxes for?

This may seem like a strange question, but taxes, and tax breaks, can have multiple purposes and objectives:

- To raise revenue for the government to fund public services;

- To influence behaviour, for example, to encourage the take up of EVs;

- To reduce environmental harm; and

- To redistribute wealth.

It is also helpful if taxes are seen to be fair by the public, do not distort behaviour in an unhelpful way and are administratively easy to calculate and collect.

Car taxes are clearly a tricky balancing act between all four objectives above.

VED - Introduction

Vehicle Excise Duty (VED) is sometimes called car tax or road tax. It raises around £8bn per year. It is an annual charge but is levied at a different rate in the year of first purchase (‘showroom’ tax) from subsequent years. This first-year rate is important as it has a direct effect on the purchase price and therefore the type of new cars that the public chooses to buy.

Electric vehicles were currently exempt from all VED, but this changed on 1st April 2025.

VED – Year 1 ‘showroom’ tax

When you purchase a car, the initial VED is dependent on the car’s CO2 emissions. For example, taking the popular Ford Fiesta, which emits 115g CO2/km, VED is £220 in the year of purchase. The most polluting category, for example luxury cars or a Land Rover emitting over 255g CO2/km pays £2,745.

For new cars registered after 1 April 2025 there are new rates of VED.

New EVs will pay a nominal £10 in the first year. For other cars the first year VED rates will double, and will continue to be based on various bands dependent on the car’s CO2 emissions. For example, a Ford Fiesta will now pay £440 in its first year, up from £220. The most polluting cars will now pay a considerable £5,490.

These are huge increases in VED at the point of purchase of new vehicles. This tax is directly dependent on the car’s CO2 emissions and is therefore a progressive, and, well designed tax. It will influence individual purchasing decisions and directly encourage people to buy low emission petrol cars and EVs.

VED (part 2): Subsequent years

Both a Ford Fiesta and a more polluting Land Rover currently were paying the ‘standard’ rate of £190 each year.

This rose to £195 from April 2025.

VED (part 3): Expensive Car Supplement

Cars with a list purchase price of over £40,000 pay an additional supplement (luxury car tax) of £410 per year in years 2 to 6 of ownership. From April 2025 this increased to £425 and will extend to EVs registered after this date for the first time.

The owner of a Tesla registered after April pays (£195 + £425) = £620 per year in years 2 to 6.

In total, over 6 years, a new Land Rover now pays £5490 at purchase, followed by 5 years of £195 standard rate + £425 supplement = £8,590.

Given the cost of the battery, EVs are on average more expensive than petrol cars. More than half have a retail price over £40,000. This additional tax therefore discriminates against EV’s, surely not what the government intends?

In my view there should be a higher threshold for EVs.

VED (part 4): pre-31/3/17 cars

For cars registered between 1/3/01 and 31/3/17 annual VED used to be between £0 for electric cars and those emitting less than 100g/ CO2/km, to £735 for cars emitting more than 255g.

Most changes to VED are not retrospectively applied because this would be unfair to existing car owners. From 1 April 2025 these rates are therefore continuing except that the zero rate will has been replaced by a new £20 rate. All pre-2017 electric cars and those emitting less than 110g now pay the new lowest rate of £20 each year.

Fuel Duty

Fuel duties are levied on the purchase of petrol and diesel, raising a substantial £24 billion per year. It is the most visible of all car taxes.

Fuel duty is viewed by many as a ‘stick’ against motorists, yet it is a useful tax. As it is directly related to car usage it helps to reduce traffic congestion and air pollution. By increasing the cost of driving it encourages the use of public transport. It also encourages manufacturers to design, and people to buy, more fuel-efficient cars and to switch to EVs.

Traditionally governments have increased fuel duty by at least inflation each year. In fact, the government applied an inflation busting ‘fuel duty accelerator’ from 1993. This policy was abandoned in 1999 due to hostility from lorry drivers and some members of the public.

Given concerns about the cost of living, the government froze fuel duty in 2011 at 58p per litre. They cut it on a ‘temporary’ basis by 5p in 2022 and then extended this rate of 53p to the present day. To help people living in rural areas, who are more car dependent, there is a 5p per litre discount for certain retailers in rural areas.

Total receipts have remained broadly flat and will fall in future as the proportion of EVs increases. It would be possible to introduce alternative revenue raising schemes such as the widespread adoption of road tolls; or a charge per km travelled but this is complicated and may bring in privacy concerns.

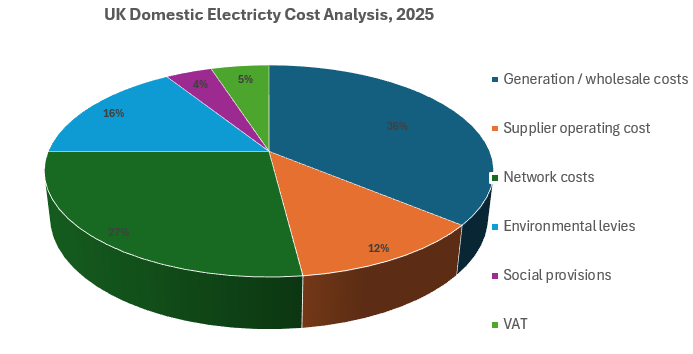

VAT

Value Added Tax is chargeable at 20% on the purchase price of all new cars. A private individual buying a new car costing £40,000 would pay an additional £8,000 VAT. Companies buying new cars can reclaim this VAT.

There is no VAT if you buy a second-hand car from another private individual, but there is if you buy from a garage showroom. However, garages who buy and sell second hand cars can take advantage of the ‘VAT Margin Scheme’ to only pay VAT on their profit margin, not the full sale price.

Interestingly, VAT is levied on the full cost of petrol and diesel including fuel duty. This seems a bit cheeky to me – taxation on top of taxation!

EV owners do not need to buy fuel, but they do pay 5% VAT on electricity when they charge at home and 20% if charging at a public charger. This may block the mass roll-out of EV’s from the suburbs into our more densely populated city centres where people are less likely to have a home charger. There is a strong case to reduce VAT on electricity for all electric chargers to 5%.

Company Car Tax

The government also supports the roll out of EVs through company car schemes. Where a company pays the leasing cost and provides a car this is treated as a non-monetary ‘benefit’ to the employee which is then subject to income tax.

This so called ‘benefit-in-kind’ is calculated as:

the list price of the car x benefit-in-kind % x your income tax rate %

There is a complicated table of ‘benefit-in-kind’ percentages dependent on the CO2 emissions of the car and the tax year in question. For 2025/26 an EV has a heavily discounted BIK of 3%, compared with 28% for a Ford Fiesta and 37% for a Land Rover.

Income tax rates in Scotland are different to those in England and Wales, but for the examples below I have used the standard higher rate tax band of 40% which most company car drivers will pay. Higher rate taxpayers will save even more.

A driver of an electric Nissan Leaf might pay (£30,000 x 3% x 40%) = £360 per year. However, a driver of a cheaper Ford Fiesta might pay more tax (£22,000 x 28% x 40%) = £2,464 per year.

You can see that there is a very strong tax break incentive for company car drivers to choose an electric car.

You might think that this only benefits a few people who are ‘lucky’ enough to qualify for a company car. But this is a deliberate policy. Most company car drivers change their vehicle regularly, so in three years’ time there will be good quality second hand EVs on sale for the public. A ‘trickle down’ effect in action.

Salary Sacrifice

Like the long-standing Cycle to Work scheme, some companies have introduced salary sacrifice for employees to lease EVs. This is for employees who are not entitled to a ‘free’ company car.

Employees pay each month to lease a new car out of their salary. This reduces your gross salary which then reduces the amount of income tax and National Insurance that you need to pay.

A new electric Nissan Leaf might cost £270/month to lease. You save around £108 (40%) in tax and are charged a benefit-in-kind of £30. The net result is that the car costs you around £192 per month or £2,300 per year.

Salary sacrifice schemes are a ‘perk’ for certain employees. In this case this tax break can be justified to encourage people to choose to buy electric vehicles although it seems unfair that the wealthiest, highest rate taxpayers who benefit the most.

Discussion

In my view there is a strong environmental and societal case to tax drivers heavily but also to use tax subsidies to encourage a shift to EVs. However as 80% of us have access to a car, car taxes are not always popular as demonstrated by the government abandoning the fuel duty accelerator.

Fuel duty and VED are good examples of car taxes that directly incentivise manufacturers to design more fuel-efficient cars. This is to be commended but clearly has not yet gone far enough given the big increase in fuel hungry SUVs purchased in recent years. The new increases in the ‘showroom’ tax are highly visible to purchasers and will directly incentivise low emission vehicles and EVs.

The new rates of VED will favour electric car drivers, but less so for vehicles costing over £40,000.

Given that fuel duty is now 5p less than it was in 2011 there is a strong case to increase it. In the medium term, new ways should be investigated to tax electric cars for each km driven. If we don’t do this then traffic congestion will increase, and other taxes will have to rise to compensate for the loss of revenue.

The tax breaks for employees to lease cars are costly to the government but they do act as a strong incentive to buy EVs. These schemes need to be kept under review to ensure that they successfully influence behaviour, without being too generous. An alternative, which might be fairer to the wider public, would be direct subsidies off the purchase price of any electric car (perhaps by reducing VAT).

--------------------------------------------------------------------------------------------------------------------------

Carbon Choices

To get first sight of my new blogs, email me at This email address is being protected from spambots. You need JavaScript enabled to view it. with the header “please subscribe”.

You might also enjoy my book, Carbon Choices, on the common-sense solutions to our climate and nature crises. Available from Amazon or a signed copy direct from me. I am donating one third of profits to rewilding projects.

Please follow me on social media:

LinkedIn, X, Facebook, Instagram and now on Bluesky

Please feel free to share any of my blogs.